Discover:

- What is payment processing?

- Who uses payment processing

- How does payment processing work?

- What equipment or technology do you need for payment processing, and who provides it?

- How did credit card processing start?

- What are the benefits of using a credit card processing partner?

- How do you evaluate a payment processing partner?

- How to get started with Amazon Pay

What is payment processing

Payment processing, credit card processing, and merchant services are all terms for the same service: a system that handles financial transactions from customers. Typically, a merchant or seller will work with a provider to be able to accept payments via credit cards, debit cards, gift cards, and customers’ bank accounts.

What are the two main kinds of payment processors?

Front-end processors

Front-end processors communicate and provide the data to authorize transactions between the point of sale and a back-end processor.

Back-end processors

Back-end processors move money from a buyer’s account to the merchant’s account.

Who uses payment processing?

The four main types of businesses that use payment processing are:

Ecommerce merchants

Ecommerce merchants are online-only businesses, sometimes called “click-and-mortar” businesses, that sell to shoppers exclusively via the internet. Ecommerce merchants integrate payment processors via secure apps and browsers to sell via desktop and mobile devices.

Retail merchants

Whether it’s entirely online or has a brick-and-mortar physical location, any organization that offers goods or services for sale to the public may be considered a retail merchant.

Wholesale merchants

Wholesale merchants buy products from manufacturers (or other wholesalers) and then resell to retail merchants, government agencies, or other businesses.

Affiliate merchants

Affiliate merchants, or associate merchants, include influencers, bloggers, and publishers who choose to include links to products or services sold by a third-party ecommerce retailer. The products are often presented as recommendations from the content creator to help them monetize their web traffic via a commission for a referral.

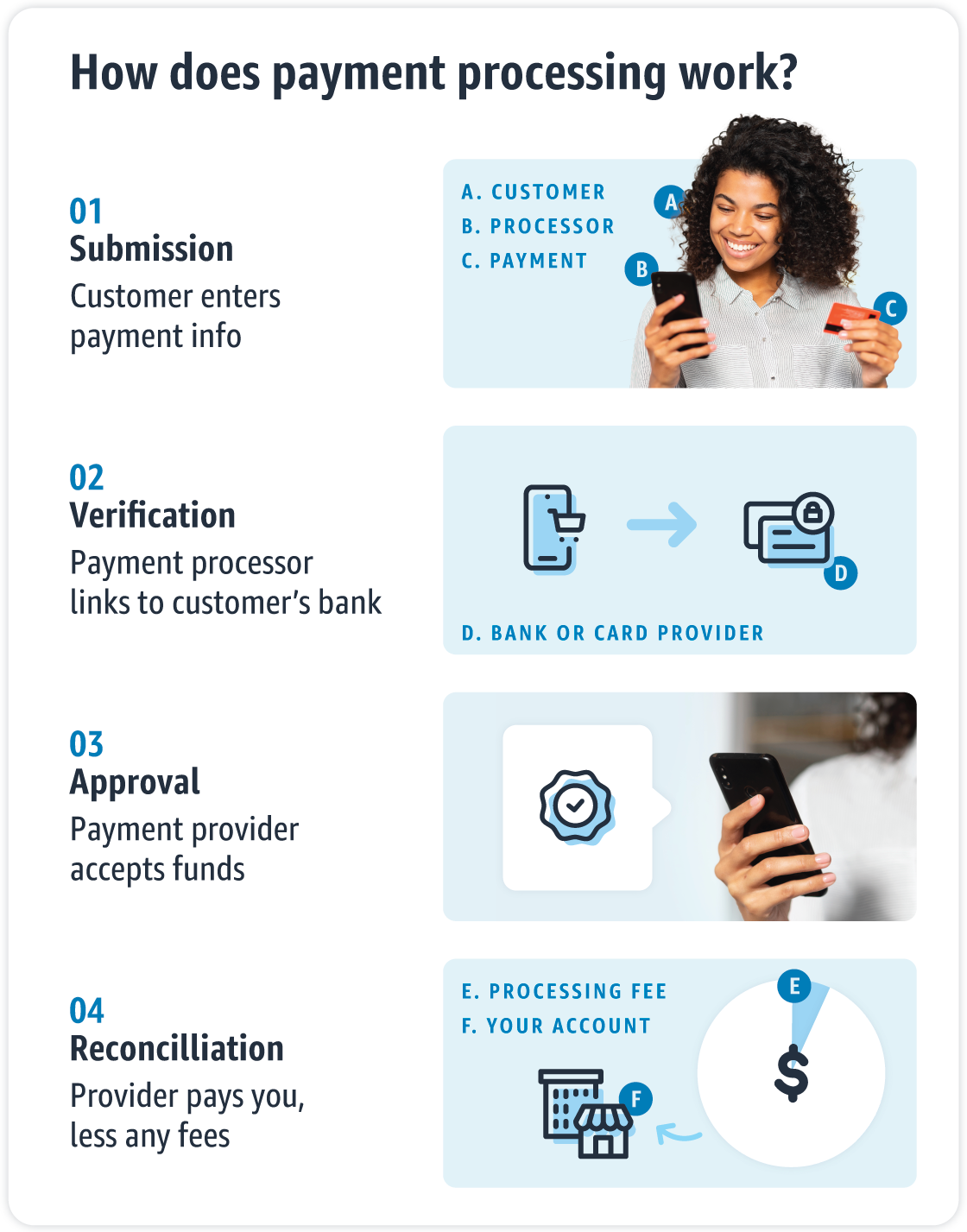

How does payment processing work?

From when a customer hands their credit card to a business to the revenue getting deposited in the merchant’s account.

1. A customer inputs their payment information into a credit card processing terminal.

2. The payment processor transmits this data to the customer’s bank to accept or decline.

3. The merchant accepts the payment if the transaction is approved.

4. The balance of the transaction is deposited into the merchant account after the payment processor takes its fee from the transaction.

What equipment or technology do you need for payment processing, and who provides it?

Your payment processing partner will provide the system, including programming, to complete transactions.

Ecommerce stores

Payment gateways

A payment gateway works much like a point-of-sale (POS) terminal but virtually. These payment gateways allow for digital transactions where the buyer and merchant do not need to actually meet. These types of exchanges are called “card-not-present” transactions, where all the credit card information is entered digitally through an app or a web checkout form.

From there, the payment gateway directs the transaction and all the credit card data to the payment processor. The payment gateway then delivers any associated approvals or rejections of the transaction to the customer and merchant.

Brick-and-mortar stores

POS systems

POS systems are designed for in-person payment transactions. Your payment processing partner will often provide payment terminals.

The three most common kinds of POS systems are:

Terminal systems

A cash register with barcode scanners, card readers, PIN pads, etc. These combine hardware and software from a payment partner.

Mobile POS systems

App-based payment processors connected to the internet via a smartphone or tablet. While these require a card scanner, usually provided by the payment processor, they allow merchants to use their own equipment.

Online POS systems

These require a card reader for transactions but allow merchants to use their own equipment, like a tablet or PC.

Credit card terminals

The most commonly used credit card terminals are the traditional countertop credit card readers customers are familiar with. Countertop credit card terminals are usually “fixed” and connected to a cash register as they do not need to be moved to complete transactions. Credit card terminals require a connection to the internet to connect to the payment processor.

Contactless payments

Modern digital devices, like smartphones and watches, often feature digital wallets that can perform transactions via contactless-enabled payment terminals. Chips in credit cards and other devices contain similar technology, which allows the same contactless transaction simply by tapping.

How does a touchless transaction work?

The payment terminal uses NFC (near-field communication) to read data from the card or device’s built-in antenna.

Are contactless payments secure?

When a customer wants to buy something, contactless payments can provide customers with additional safety as their devices/cards will generate a one-time-only token or code for each new payment.

How does a shopper know if their personal credit/debit card or device can make contactless payments?

Both the payment terminal and the customer’s credit card, smartphone, or other personal device will have a contactless symbol.

Why are tap-to-pay touchless payments becoming so popular?

● Customers and merchants are adopting touchless payments more and more because they eliminate physical contact between the shopper and the terminal.

● Contactless payments are becoming the norm for merchants with physical stores as they provide quick and easy checkouts for shoppers and can reduce the time they spend in checkout lines.

● Smartphones and smartwatches also give customers more ways to customize their tap-to-pay transactions by letting them change the debit or credit card they use without having to provide physical cards.

Mobile payments

Mobile POS

Instead of using a traditional countertop credit card terminal, mobile payment processors allow merchants to use smartphones or tablets as mobile POS systems. To do this, the store uses a credit card reader to communicate with the mobile device. Customers can then swipe, dip, or tap a contactless credit card just as they would at a countertop terminal, and the merchant can accept payments wherever they are so long as they are connected to Wi-Fi.

Online and in-app mobile payments

Mobile payments include browser-based payments and in-app purchases accessed from a mobile device.

Browser-based payments

May require a customer to create a new account and enter their payment information before completing their checkout, or a merchant’s ecommerce website may have a checkout button that uses a customer’s existing account to complete purchases.

In-app mobile payments

Are for stores and businesses with their own apps with built-in ecommerce functions. Instead of using a browser to visit a physical store’s site, customers can shop and check out more seamlessly with a store they already know, and often without having to re-enter their account information.

Virtual terminals

A virtual terminal is an application that allows a retailer to accept payments from a customer’s credit card without the physical presence of the card. Before approving a CNP transaction, to verify a customer has the physical card they are attempting to use, the virtual terminal will often require the customer to enter the credit card’s security code. Virtual terminals are an attractive option for many stores as they provide merchants the flexibility to choose the device they want to use for transactions, including computers, tablets, and mobile phones.

How did credit card processing start?

What are the origins of credit card processing?

From the first electronic financial transactions to today’s contactless and app-based payments, the ease and speed of paying for things electronically has appealed to customers and businesses.

The first credit cards were innovative but only worked at a few stores (around the block from the bank that issued them), and shoppers had to wait while the business sent a runner or made phone calls to verify every transaction.

As more businesses accepted credit and debit cards, shoppers could only use their cards in person, and businesses would need at least 24 hours to verify payment.

The digitalization of financial information has helped streamline and secure transactions. Technologies like electronic payments, RFID (radio-frequency identification) housed in debit and credit cards, digital wallets on mobile devices, and encrypted online payment processors like Amazon Pay continue to benefit both merchants and customers.

Even though paying with cash, checks, and credit cards continues today, consumers have come to expect constant innovations toward frictionless shopping experiences.

What is the current state of credit card processing?

Today, businesses have many options when choosing payment processors, but deciding on a merchant solution and integrating it into a business can be difficult, particularly if it means connecting newer solutions with older payment technologies.

Instead of opting for siloed services from multiple providers, business owners today look for a payment processor that can:

1. Leverage the latest technologies

2. Integrate with existing systems easily

3. Streamline payments for shoppers

4. Provide dedicated technical support

5. Help grow their customer base

6. Accept multiple payment types

7. Reduce chargebacks and fraudulent transactions

...and is a recognized and trusted provider in the payment sector.

What is the future of credit card processing?

Shoppers will always want more convenience. And the best payment processors are exploring innovations like one-click payments, e-wallets on mobile/wearable devices like smartwatches, cryptocurrencies, and touchless, autonomous retail.

The checkout-less checkout

Autonomous retail is a major innovation in payment technology that is gaining ground due to the ease and speed customers get when shopping. In an autonomous retail location, visual data and sensors track and manage both the shopper journey from entrance to exit and inventory. A customer pays using tap-to-pay (NFC-enabled) credit or debit cards, phones with mobile wallets, or even uniquely identifiable biometrics, like a handprint, at various checkpoints.

Learn more about autonomous retail.

What are the benefits of using a credit card processing partner?

For small to medium businesses

Why should merchants work with a payment processing service?

Gone are the days when businesses had staff accountants whose sole responsibility was processing customer payments. As the retail industry has grown, so has payment complexity, customer expectations, and the need to stay competitive by reducing manual processes. Today, small- and medium-sized businesses often don’t have the time or resources to build and maintain their own payment processing systems.

For small- and medium-sized businesses, the benefits of a payment processing partner include:

1. Lowering operating costs

2. Freeing up resources the business can spend elsewhere

3. Updating and maintaining technology while incorporating ecommerce plug-ins and payment methods

4. Ensuring secure transactions are PCI-compliant and providing basic consumer protections

5. Reducing or eliminating security incidents, such as fraud

6. Streamlining and optimizing checkout experiences for customers

7. Increasing consumer confidence around every transaction

8. Integrating data, analytics, CRM systems, and other business tools for increasing revenue

9. And more

For enterprise-level organizations

Why should enterprise businesses work with merchant services?

Larger organizations often benefit from their scale, but there are downsides to handling transactions internally that can affect their bottom line. One of the biggest reasons enterprise-level businesses use ecommerce providers for payment processing is to reduce the company’s reliance on internal IT resources. Using a trusted third-party payment partner can offload a company’s need for internal payment technology development, engineering, upgrades and maintenance, tech support, customer service personnel, and cybersecurity and compliance.

A payment processing service can also help large business marry their own customer data to marketing, loyalty, and operational data to provide a consistent customer experience across all markets and channels.

What are the benefits of working with merchant services for enterprise-level businesses?

1. Security: Integrates and maintains technology to prevent fraud, protect data, and safeguard customer information

2. Flexibility: Ability to customize services, APIs, and SDKs and to accept multiple payment methods internationally

3. CRM and other integrations: Enterprise-level capacity to consolidate payments into the business’s sales stack with increased data, insights, and transparency

4. Lower operational costs and increased revenue: Reducing manual processes and streamlining checkouts can increase customer conversions while lowering operational spend

5. Learn more about online payment services for large enterprises

How do you evaluate a payment processing partner?

For small to medium businesses

For small to medium businesses, here are questions to consider when evaluating a payment processing partner

Evaluate the pricing of a potential payment processing partner

1. What are the fees for using the provider, and are they monthly fees or per-transaction fees?

2. Are there setup costs?

3. Are fees flat rate or tiered?

4. Are fees passed along to your customers?

Some providers charge a flat rate, while others require a monthly subscription fee in addition to a per-transaction fee. If a business sells to customers internationally, providers will charge an additional foreign transaction fee for currency conversions. It’s important to have a clear picture of all the fees and potential costs to the business before choosing a payment processor.

What kinds of payments do you want to accept?

Businesses need to decide which payment methods are most valuable to the company and ensure the payment provider supports them.

Are you mostly transacting online or in person?

Many small and medium businesses are online only, with an ecommerce site as the main destination for shoppers. Online-only click-and-mortar stores often just need a third-party provider to process their payments at checkout. Businesses with both online and offline locations should consider a provider that is able to provide and support countertop POS terminals, mobile POS terminals, or virtual terminals as well as online checkouts.

What are the security features of the payment provider? Is there fraud protection?

Payment security is critical to protect customers and the business from fraud. If a small- or medium-sized business doesn’t have the resources to protect a customer’s payment info or data, then a third-party payment solution can help. The payment method a business chooses should be PCI-compliant and encrypted to secure customers’ data. Additional safeguards include using CVV, one-time passcodes, or biometric authentication like fingerprints, voice recognition, or face recognition.

Do you need hardware (terminals)? If so, what kind of hardware do you need?

Today, providers offer a range of hardware for in-person checkouts. If a business needs a provider to supply hardware, the type of hardware will depend on the business’s size, the kind of business, and the number of employees a business has. For example, a small cafe may only need one countertop tablet device and a card reader to process payments. A larger restaurant with multiple servers may need several mobile card terminals or credit card readers that use mobile phones and connect to the internet.

What kind of technical support do you need?

Businesses are only as good as the tools they have to use. That’s why knowing your provider is available to support you whenever you need can be mission-critical for sales.

Integrating a payment processing solution onto your ecommerce site should be an easy process, because not every business owner has a web development team ready to handle integrating payment processors. In addition to having access to extensive online technical resources for questions or technical issues, merchants should be able to contact the provider’s support team via email, phone, and/or chat whenever they are needed.

Learn more about what to look for when deciding on a payment processor for your business.

Questions to ask any potential credit card processing partner for enterprise-level organizations

1. What is the pricing?

2. Do you receive benefits at scale?

3. What kinds of payments are you accepting?

4. What are competitors using?

5. Are you mostly transacting online or in person?

6. What kind of hardware do you need?

7. Does the provider offer enterprise-scale support?

How to get started with Amazon Pay?

Amazon Pay works with a range of service providers who can help you set up Amazon Pay on your ecommerce site quickly and easily, and get you back to focusing on building your business.

How Amazon Pay approaches payment processing

Is Amazon Pay trusted by top brands?

Top brands have learned that with Amazon Pay, they can offer shoppers a trusted, convenient checkout experience with one familiar log-in to lower cart abandonment and optimize their CX.

Not only do top brands trust Amazon Pay but offering it on your site is an opportunity to benefit from one of the most trusted brands in the industry, ranked No. 3 in reputation by a 2020 Axios Harris Poll.4

Does Amazon Pay have international capabilities?

Amazon Pay is available for established merchants in the United States, United Kingdom, Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, Ireland, Italy, Japan, Luxembourg, the Netherlands, Portugal, Spain, Sweden, and SwitzerlandAmazon Pay multi-currency capabilities make it easy for merchants to expand into new geographies and sell cross-borders. Shoppers can buy the products they love in their preferred currency, and businesses can receive funds into their bank accounts in the currency they prefer.

Does using Amazon pay lead to faster checkout times?

Amazon Pay gives shoppers faster checkouts — 49% faster transactions than regular checkouts.5

If you use Amazon Pay, do your customers need to create new accounts?

Making a shopper create an account before buying an item they love can increase cart abandonments. Using the information already stored in their Amazon accounts, Amazon customers can pay on a business’s ecommerce site easily and without the added steps.

What are Amazon Pay’s fraud and prevention policies?

Shoppers can feel safe knowing that Amazon Pay is backed by the same fraud protection technology used on Amazon.com. With Amazon Pay, businesses can choose to process authorizations asynchronously, giving Amazon’s fraud models more time to analyze transactions for potential fraud. Learn about what ecommerce businesses can do to prevent fraud.

What is the Payment Protection Policy (PPP)?

The Payment Protection Policy may protect businesses from chargebacks, or charge disputes. If a transaction qualifies, Amazon Pay covers the chargeback with the required information. Learn more about the PPP by visiting Amazon Pay’s Chargeback FAQ.

What is the Amazon Pay A-to-z Guarantee?

Amazon has millions of satisfied customers and is always responsive to their concerns about a purchase. If a shopper isn’t satisfied with a purchase, they can file an Amazon Pay A-to-z Guarantee claim and potentially obtain a full reimbursement for their purchase or cancel their authorized payment if they are not satisfied.

What IT support does Amazon pay offer?

Businesses that want to offer digital payments need a seamless integration experience. If a business uses a third-party ecommerce platform (like BigCommerce, Adobe Commerce, and Woo), Amazon Pay integrates seamlessly with the solution provider so that adopting the payment service becomes plug-and-play. If a business has a custom-built website, it can rely on Amazon Pay to offer the technology and expertise to facilitate a seamless custom integration.

Amazon Pay offers innovative payment services for small and medium businesses to optimize checkouts, increase conversions, and build a better customer experience.

Amazon Pay is the leading online payments service for large enterprise businesses. Build and scale by tapping into the expertise of enterprise specialists focused on your business’s success.

1 https://www.westernunion.com/blog/en/6-fascinating-things-about-western-unions-history/

2 “Paying with plastic: the digital revolution in buying and borrowing” MIT Press. https://archive.org/details/payingwithplasti0000evan

3 “Timeline: The creation and evolution of credit card payments.” FinTech Magazine, June 2021; https://issuu.com/fintechmagazine/docs/fintech-june2021_

4 Axios Harris Poll 100, Corporate Reputation Rankings, July 2020.

5 “Amazon Pay transactions took an average of one minute and 27 seconds, a 49 percent time reduction from the two minutes and 53 seconds that regular checkouts take.” –PYMTNS.com Buy Button Report 2021, February 2021.